Forex essential Assessment is actually a cornerstone of successful trading, giving important insights in to the forces driving currency values. It will involve analyzing financial indicators, political situations, and marketplace sentiment to predict upcoming price movements. This information aims to offer a radical understanding of forex fundamental Examination, supporting traders make knowledgeable selections and enhance their trading methods.

Precisely what is Forex Elementary Examination?

Forex basic Assessment will involve inspecting macroeconomic indicators, for instance GDP, curiosity prices, and inflation, to determine the intrinsic price of a forex. Compared with complex Evaluation, which focuses on price designs, basic analysis assesses the broader financial setting to predict forex movements.

Key Financial Indicators in Forex Elementary Assessment

Knowledge essential economic indicators is crucial for successful forex fundamental Assessment. These indicators give insights into a country's financial health and impact currency values.

1. Gross Domestic Products (GDP): GDP actions a rustic's economic output and advancement. A climbing GDP indicates a wholesome overall economy, usually bringing about a more powerful forex.

2. Curiosity Fees: Central financial institutions manipulate desire charges to manage inflation and stabilize the financial state. Greater desire prices commonly entice overseas expense, boosting the currency worth.

3. Inflation Fees: Inflation actions the rate at which costs for merchandise and providers increase. Moderate inflation is typical, but abnormal inflation can erode a forex's obtaining energy.

Central Financial institutions and Financial Plan

Central banks Perform a pivotal position in forex elementary Examination. They established desire prices and employ financial insurance policies to manage financial steadiness.

one. Desire Amount Selections: Central banking companies regulate interest premiums to manage inflation and stimulate or awesome down the financial state. Traders watch these selections carefully because they may cause substantial currency fluctuations.

two. Quantitative Easing: This plan consists of obtaining govt securities to enhance the revenue offer. It aims to reduce interest prices and encourage financial expansion, often weakening the currency.

Political and Geopolitical Activities

Political stability and geopolitical situations appreciably effects forex values. Elections, policy variations, and Worldwide conflicts may cause market place volatility.

1. Elections: Election outcomes can lead to plan improvements influencing economic growth and stability. Industry sentiment typically shifts depending on the perceived financial affect of the new administration.

two. Geopolitical Tensions: Conflicts and tensions involving nations can disrupt trade and economic steadiness, bringing about currency depreciation.

Trade Balances and Current Accounts

Trade balances and latest accounts mirror a country's financial transactions with the rest of the entire world. They offer insights to the demand for a rustic's currency.

one. Trade Harmony: The trade balance actions the distinction between a country's exports and imports. A constructive trade stability (surplus) implies more exports than imports, strengthening the forex.

two. Current Account: This accounts for all Worldwide transactions, together with trade, financial investment revenue, and transfers. A surplus implies a Web inflow of international Forex Fundamental Analysis forex, boosting the forex's benefit.

Industry Sentiment and Speculation

Current market sentiment, driven by investors' perceptions and speculations, can cause brief-phrase currency fluctuations. Knowledge industry psychology is important for forex basic Investigation.

one. Trader Assurance: Good economic news can Raise Trader assurance, bringing about amplified demand from customers for the currency. Conversely, damaging information may result in forex offer-offs.

2. Speculative Buying and selling: Traders normally speculate on future economic activities, driving currency rates based mostly on their anticipations. These speculative moves could cause brief-phrase volatility and produce buying and selling options.

Making use of Forex Basic Analysis in Investing

To use forex fundamental Assessment effectively, traders will have to continue to be knowledgeable about financial activities and knowledge releases. Here is a stage-by-phase technique:

1. Stay Current: Often observe economic information, central financial institution announcements, and geopolitical developments. Financial calendars are precious equipment for tracking critical gatherings.

2. Analyse Information: Examine how economic indicators and events align with your buying and selling technique. Consider the probable impact on currency values and sector sentiment.

3. Acquire a method: Use essential Examination to create a buying and selling technique that accounts for financial trends and likely market shifts. Merge it with technical Evaluation for your holistic strategy.

four. Threat Administration: Fundamental Examination may help recognize probable hazards and opportunities. Employ risk management tactics to shield your investments and maximise returns.

Common Queries and Problems

How precise is forex essential analysis?

Fundamental Examination is not really foolproof but provides useful insights into current market trends. Combining it with technical analysis can boost accuracy.

Can newcomers use elementary Investigation?

Certainly! Inexperienced persons can get started by being familiar with vital financial indicators as well as their effect on currency values. With time, they are able to create more sophisticated procedures.

How frequently really should I complete basic Examination?

Normal analysis is important for powerful trading. Stay current on economic events and periodically assessment your technique based on new facts and industry conditions.

Summary

Forex fundamental Assessment is An important tool for traders trying to get to grasp and anticipate market place actions. By analysing economic indicators, central lender policies, political gatherings, and industry sentiment, traders will make informed selections and develop sturdy investing techniques. Continue to be informed, frequently refine your method, and Blend fundamental Examination with other techniques to realize investing success.

Mara Wilson Then & Now!

Mara Wilson Then & Now! Andrea Barber Then & Now!

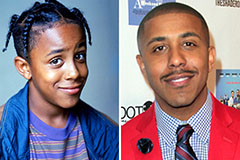

Andrea Barber Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!